Audit Report Examples Sample Audit Reports of Facebook & Tesco Plc

Contents:

Paragraph 43-1 of ISA requires the auditor to report on specific matters by exception in certain circumstances. This section is required where the relevant legislation requires the auditor to report, by exception, on specified matters and needs to be tailored to the legal requirements. Requires every audit report to include a “Basis for Opinion” section, directly following the Opinion section. This is required regardless of whether the audit opinion is unmodified or modified. The auditor’s work in relation to going concern has been enhanced in ISA 570 ,Going Concernand the ISA includes additional guidance relating to the appropriateness of disclosures when a material uncertainty exists.

The guidance focuses primarily on the two additional requirements and situations where an auditor is engaged to report on KAMs. Subsections .10–.13 and the related guidance points A13 through A40 are particularly important. If you are writing a financial audit report, for example, it is important to understand there are four basic types of opinion that can be expressed. Which opinion you express affects the tone, structure, and organization of an audit report, and the type of opinion you express is determined by the results of the audit. Other types of audits can use the same types of opinions.A clean opinion is used if an entity’s financial statements are a clear representation of an entity’s financial opinion. The auditor’s responsibility is to plan and execute the audit to procure assurance regarding the financial statements.

Preparing to Write an Audit Report

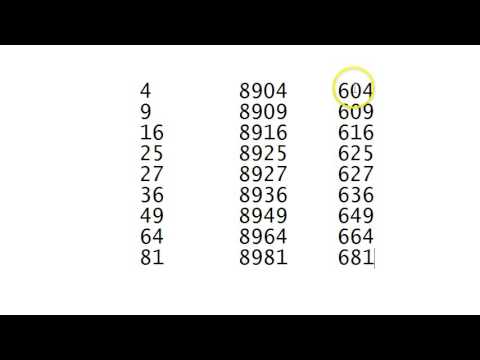

When selecting samples, non-statistical sampling allows an auditor to utilize professional judgment. When a population is very small, non-statistical methods make a lot more sense than investing time in setting up a statistical sample. While non-statistical sampling provides for auditor discretion, an auditor should always exercise caution when picking samples. Because financial statements are created internally by businesses and organizations, there is a high danger of manipulation and fraudulent activity in the process. For example, in statistical sampling, ten items are chosen at random from the overall population. As a result, every single item in the 100 has an equal chance of being chosen and checked for correctness.

An Audit ReportAn audit report is a document prepared by an external auditor at the end of the auditing process that consolidates all of his findings and observations about a company’s financial statements. For purposes of the ISAs, KAMs are matters that, in the auditor’s professional judgment, were of most significance in the audit of the financial statements of the current period. In the author’s opinion, most people who are familiar with the current audit reports would agree with James Gunn that users go directly to the opinion paragraph. The basis of opinion in the new audit report represents a change for the better.

The Goal of Audit Sampling

Where the entity is not required under law to prepare a directors’ report or strategic report, there is no requirement for the auditor to report on any such reports that have been voluntarily included in the annual report. For further information, refer to theAudit and Assurance Faculty guidesand select the guide that is relevant to the type of entity you are auditing. The audit of Turquoise Industries Co has been completed and the auditor discovered a material amount of research expenditure which had been capitalised as an intangible asset in contravention of IAS 38® Intangible Assets. In this type of audit report, auditors express that there is a problem in financial statements but the problem is not too serious.

Contains the https://1investing.in/ of independent auditors about the company’s financial statements such as Income Statement, Balance Sheet, Cashflows, and Shareholders’ equity statement. Auditor reports can be found in companies’ annual reports just before the financial page. An adverse opinion on an audit report is the worst possible report that you can get. An adverse opinion means that the misstatements in the financial statements are both material and pervasive. An adverse opinion can damage a company’s reputation and even have legal ramifications unless the issues are corrected.

What is population in audit sampling?

This necessitates that all items or sampling units in the population have a chance of being chosen. Some auditors adopt a rule of thumb of testing a sample size of around 10% of the population for populations between 52 and 250 items, although the size is subject to professional judgment, which would incorporate specific engagement risk assessment concerns. SOC auditors should examine their audit sampling methods to ensure they are in accordance with AICPA guidance while conducting examinations.

It says that the company is involved in a number of legal proceedings. The company has to follow the basic principles of accounting including accruing the probable liabilities. The auditor communicates the important areas of the evaluation to the audit committee.

GAAP are standardized guidelines for chart of accounts example and financial reporting. Let us discuss the above format of the audit report in detail. GAAP GAAP are standardized guidelines for accounting and financial reporting.

With ChatGPT and GPT-4, it’s time for regulators to crack down on AI – Vox.com

With ChatGPT and GPT-4, it’s time for regulators to crack down on AI.

Posted: Wed, 12 Apr 2023 18:20:00 GMT [source]

If you think about it though, all the reports above fit under the same description. It’s just the environment where it’s produced and presented that’s different. This definition of a report applies to both businesses and schools. Energy Audit ReportEnergy Audit Report Template is used to assess the energy consumption of a company and how they can save more energy by optimizing the right items. In addition, you can easily modify the fields according to your immediate needs.

Audit sampling can be done in a variety of ways, including the methods listed below. Audited Financial StatementsGenerally Accepted Auditing Standards Tally makes it easy for the organization to accurately record all their transactions in compliance with GAAP. If you are worried about how to prepare a balance sheet with no errors, Tally is your answer. It also makes it more straightforward for auditors to access all the information that they need in a very simple and transparent manner.

Hence, shareholders require a third-party assurance on their financial statements. Based on the report, they have provided an unqualified clean opinion; it means the auditor is satisfied with the financials provided. The CPA Journal is a publication of the New York State Society of CPAs, and is internationally recognized as an outstanding, technical-refereed publication for accounting practitioners, educators, and other financial professionals all over the globe. Edited by CPAs for CPAs, it aims to provide accounting and other financial professionals with the information and analysis they need to succeed in today’s business environment. The ASB uses the same definition as the International Auditing and Assurance Standards Board . The ASB has made great efforts through its clarified standards to converge with the IAASB.

Likewise our COBIT® certificates show your understanding and ability to implement the leading global framework for enterprise governance of information and technology . Beyond certificates, ISACA also offers globally recognized CISA®, CRISC™, CISM®, CGEIT® and CSX-P certifications that affirm holders to be among the most qualified information systems and cybersecurity professionals in the world. Gain a competitive edge as an active informed professional in information systems, cybersecurity and business.

- Among the four types of audit report, unqualified audit report is the report that auditors usually issue most of the time.

- Candidates attempting Audit and Assurance and Advanced Audit and Assurance are required to have a sound understanding of these standards.

- The sampling method employed should produce an equal chance of selecting each unit in the sample.

- The term “audit report” refers to the auditor’s documented opinion regarding the financial statements of the subject company.

- In this type of audit report, auditors express that there is a problem in financial statements but the problem is not too serious.

Where the auditor has identified conditions which cast doubt over going concern, but audit evidence confirms that no material uncertainty exists, this ‘close call’ can be disclosed in line with ISA 701. This is because while the auditor may conclude that no material uncertainty exists, they may determine that one, or more, matters relating to this conclusion are key audit matters. Examples include substantial operating losses, available borrowing facilities and possible debt refinancing, or non-compliance with loan agreements and related mitigating factors. So, it can be seen that an auditor issues an audit report after conducting a thorough evaluation of the books of accounts and the financial statements of a company.

There is a significant addition, however; when required by the applicable financial reporting framework, an additional paragraph should be added dealing with conditions or events that raise questions about the entity’s ability to continue as a going concern. The AICPA Auditing Standards Board recently issued SAS 134, Auditors Reporting and Amendments, Including Amendments Addressing Disclosures of Financial Statements, and SAS 135, Omnibus Statement on Auditing Standards—2019. This article summarizes the new standard and provides insights for auditors implementing its provisions. The board of directors, the organization’s stakeholders, shareholders, investors, etc., use this report. It is the responsibility of the Auditor to make this audit report in a standardized format every year after reviewing the organization’s financial statements. The auditor must be meticulous and unbiased while preparing the report.